Base rate entity eligibility tests worksheet (bre) - PS Help: Tax - Australia 2018 - MYOB Help Centre

Base rate entity eligibility tests worksheet (bre) - PS Help: Tax - Australia 2018 - MYOB Help Centre

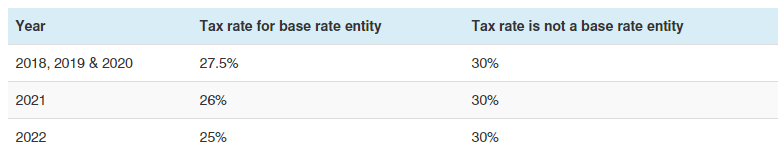

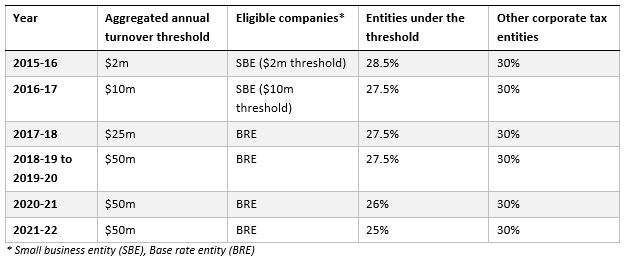

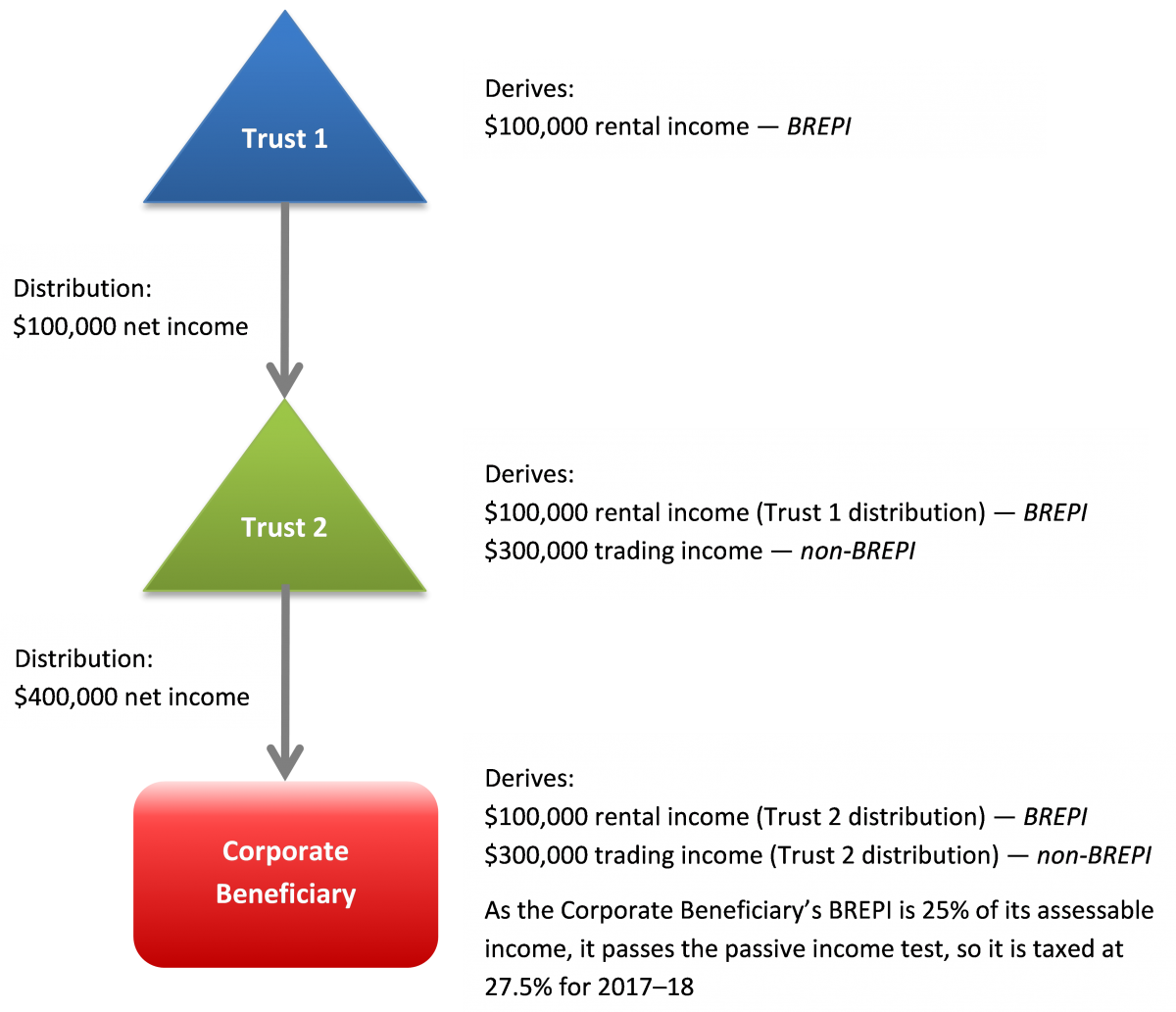

Revised Base Rate Entity (BRE) Corporate Tax Rate Rules – Is your company on a 27.5% or 30% tax rate?

Base rate entity eligibility tests worksheet (bre) - PS Help: Tax - Australia 2019 - MYOB Help Centre